2023 trend

2023 was dominated by inflation with Central Banks like FED and BCE that had to balance the economic growth and the control of inflation. This is the overall scenario that has characterized the economic dynamics, with a strong influence on Italy which had a growth in GDP lower than 1% during 2023 and worsened by a decrease in investments in the construction sector after the end of Superbonus.

Even though the Italian salaries have had an increase, they could not keep up with inflation, despite a cut in the tax wedge extended to 2024. The slow pace of economic growth is a common topic according to the European average.

The first semester of 2024 has shown a slowdown on a global scale, catalyzed by geopolitical tensions, especially the war in Ukraine. The global energy supply was the direct consequence of price rise and an increase of inflationary pressure, that highlights a portfolio diversification against external shocks.

With the increase of inflation, many Central Banks have adopted restrictive monetary policies which are essential for controlling inflation, but they have the secondary effect of slowing the economic growth. This situation has given rise to different doubts regarding the sustainability of these policies in the long run pointing out the need to find a balance between the control of inflation and the support of economic growth.

Forecast for 2024

2024 is going to be a year of opportunities and challenges. According to the forecast of UniCredit, the global GDP is going to increase by 2.3% in 2023 and 2.6% in 2024. However, the trimestral forecast of BCE states that inflation in the Eurozone may stay above 3% in 2024. Despite the recession of the USA, there may be a decrease in inflation, followed by a low growth in the Eurozone.

It is possible that throughout 2024 there will be a significant increase in the price of gold with the possibility of reaching unmatched levels. This growth is influenced by the decrease of interest rates and the concern of a possible recession, with a consequent importance of gold as a safe store of value.

The positive perspectives of precious metals are dominated by two key elements. In the first place there is a special attention to the policy adopted by the Federal Reserve. The future seems uncertain, fluctuating between the possible tax rates increase and the upcoming end of increases. Since March 2022 the Federal Reserve has implemented an increase of rates as a response to a relentless inflation that had reached the highest levels in the last 40 years. In less than two years rates went from 5.25% to 5.5%. We are currently observing a decrease in inflation and after a break of increase in June (except July), the restrictive policies may slow down. It is possible that the price of gold may benefit from this situation with its consequent increase.

That is the reason why in a context of economic uncertainty, investors need solutions that protect the value of their investments. Gold is a safe haven, a reliable resource during times of economic turmoil. It offers protection against inflation and it is essential for the diversification of the portfolio.

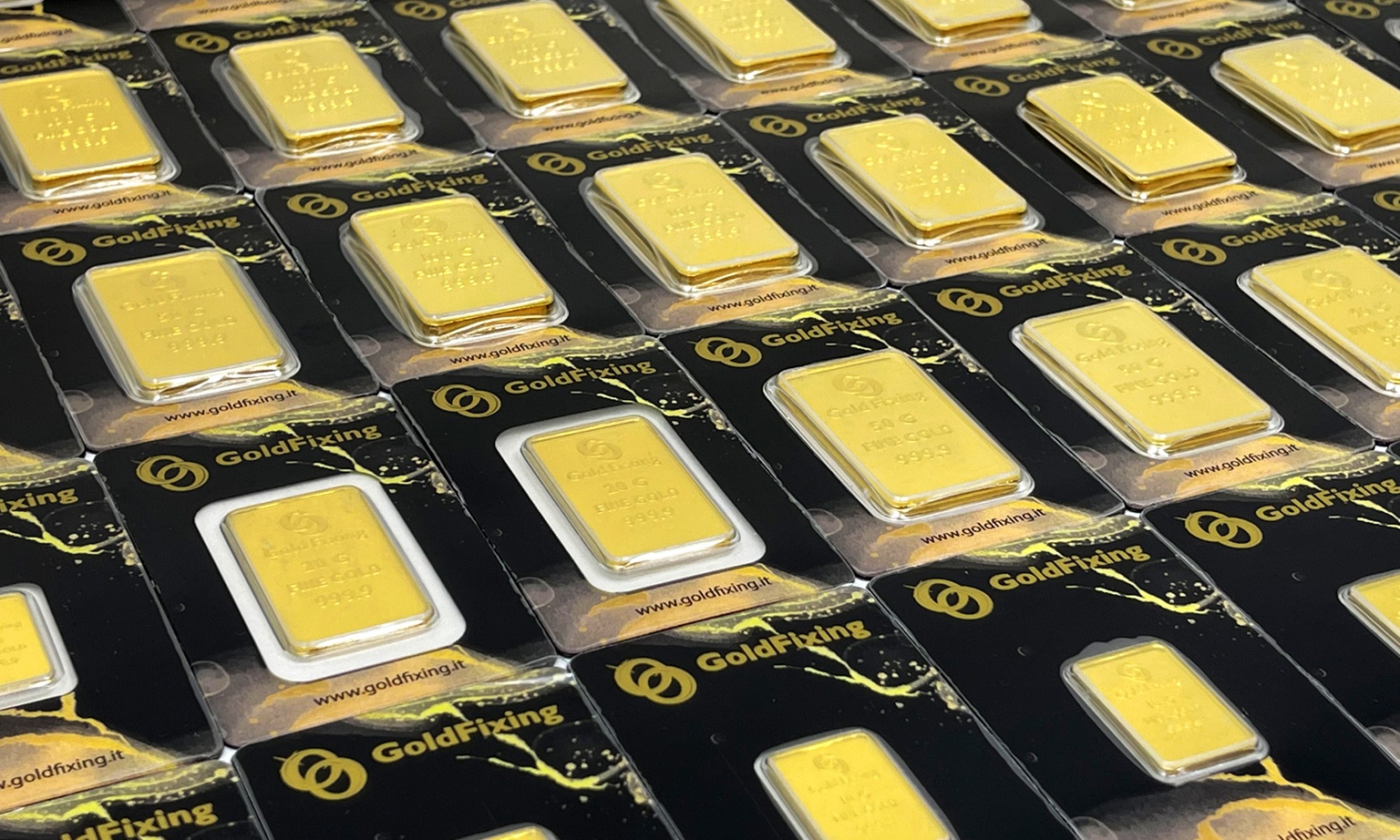

Physical gold in the form of gold bars and coins turns out to be an attractive option due to its tangibility and its resistance to economic crises. Unlike other traditional investments, physical gold represents a form of wealth that resists catastrophic events.

Despite the challenges of 2023, the upcoming year seems to be a year of hope. Investors are strongly encouraged to consider gold and other precious metals as part of their investment strategy, offering protection against future uncertainties and capitalizing the emerging opportunities. Gold is still a shield against the complexities of the global economy.