Gold is considered the utmost store of value due to its capacity of preserving the value over time even during times of inflation or economic crisis.

The last few years have been hard for the global economy as a confirmation of the importance of investing in gold.

In times of instability like the current ones, investing in gold is a safe choice, despite the race for rare metals, which is the cause of price increase.

Looking at the trend of the Stock market, we can notice that the price of gold moves against the trend. In fact, when we have a bear Stock market, gold is in a continuous increase, turning into a stabilizer of the portfolio.

In 1973/1974 Morgan Stanley Capital International (MSCI) lost 34%, while the gold bar gained 62%. Equally during the financial crisis of 1979 MSCI lost 6% and the gold bar had an increase of 28%. During the severe crisis in 2008 MSCI registered a loss of 50%, while the gold bar gained 41%.

Eventually, three years ago during the pandemic COVID-19, Stock markets experienced a loss of 23% and gold an increase of 41%.

During the economic crisis of the last months in Europe, gold gained more than 7% euros, while MSCI reported a total loss of 13%.

This is a clear example of why gold is considered a staple for the investors in this time of financial and geopolitical crisis; without neglecting the importance of the time frame, physical gold is a smart investment, the safest way to invest and reduce all sorts of risks.

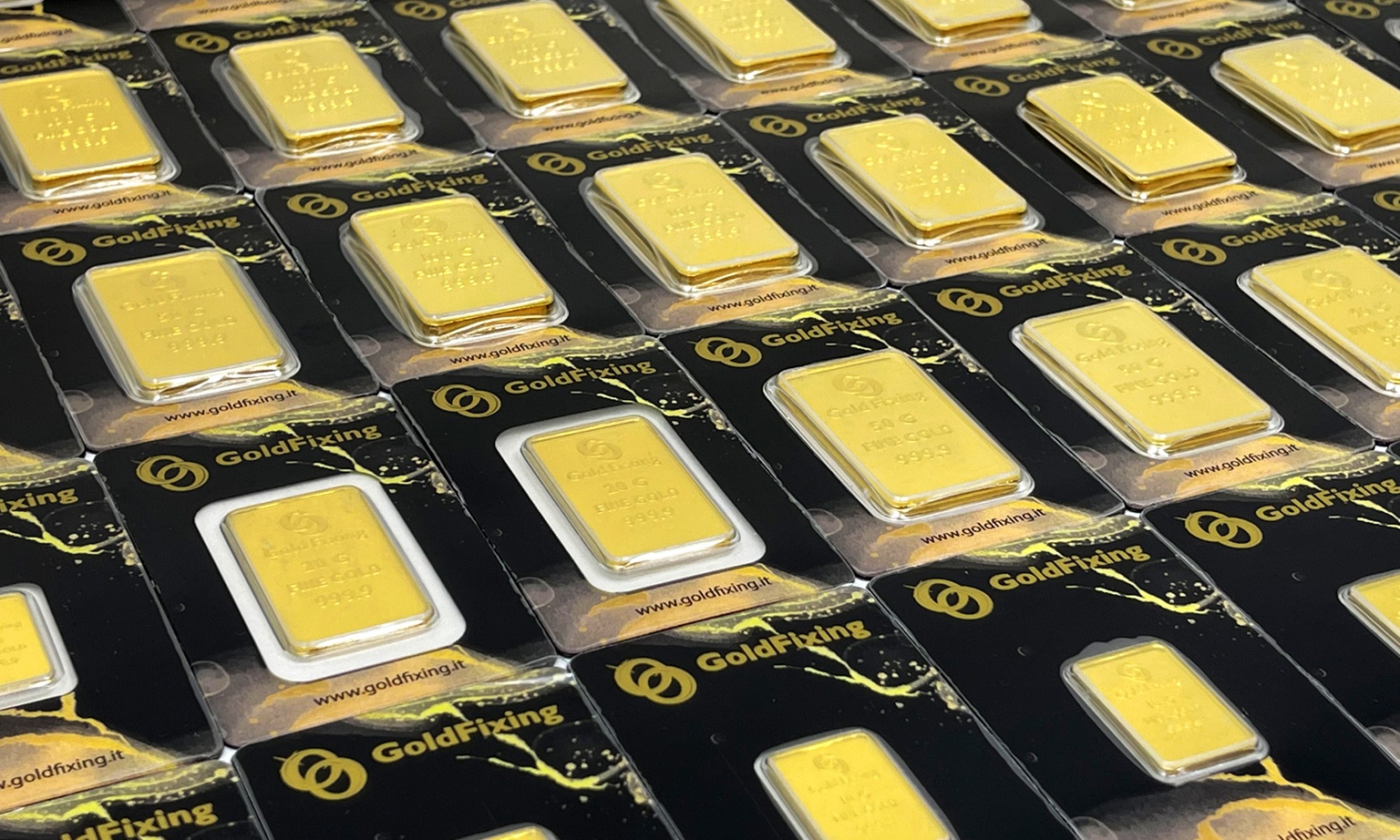

Gold Fixing helps you through the process of investment in gold, which is a store of value that:

- Keeps its value

- Diversifies the portfolio

- Resets the risks

It also protects investors from:

- Inflation

- Market crisis

- Risks of losing value and inconsistency of other investments

- Risks associated with the counterparty

And if you ask us: “When is it worth investing in gold?”, we answer:

“It’s always a good time to invest!”.