There are different risks associated with digital currencies and they can be divided into three main categories:

- Safety risks

- Regulatory risks

- Uncertainty risks

Safety risks include the possibility to hack digital portfolios where crypto currencies are kept. If a hacker has access to a digital portfolio, they will be able to steal the crypto currencies, without any chance to recover them. Moreover the transactions of crypto currencies are not reversible, meaning that if an operation is carried out fraudulently or in the wrong way, it is impossible to undo.

Regulatory risks are associated with lack of regulations for crypto currencies in many countries. It means that there aren’t legal protections for the users in case of fraud or other issues. In addition, lack of regulations might make it difficult for companies to accept crypto currencies as a method of payment.

Uncertainty risks are linked to a strong fluctuation in prices of crypto currencies. Prices of crypto currencies can vary in a short time, sometimes unpredictably. It means that users may lose a significant value of their investment in crypto currencies in a short time.

The use of digital currencies is risky and users should carefully consider that before using them. It is important to understand the implications of the risks and adopt precautions to minimize them.

Diversification of the portfolio

Diversification of the portfolio is an important strategy to manage the risks of investments. Instead of gathering all the investments in one class of assets or in one investment, diversification consists of distributing money on multiple assets and classes of investments.

It means that if an asset or an investment suffers a loss, the other investments in the portfolio can compensate for the loss. In addition, diversifying the portfolio may help to catch more earning opportunities in several sectors.

For example, a diversified portfolio may include shares of different societies, obligations, real estate funds, raw materials and foreign currencies. Thus the portfolio would be more exposed to different earning opportunities and less vulnerable to losses in one single sector.

In general diversification of the portfolio depends on the needs of every single investor, on their risk tolerance and the long-term financial goals. Once these factors are determined, it is possible to develop a strategy of diversification that takes into account the needs and individual goals.

It is important to remember that diversification of the portfolio does not ensure the success in the investments or a full protection from risks, but it can help to manage the risks and maximize the earning opportunities.

Why is it so important to diversify with gold?

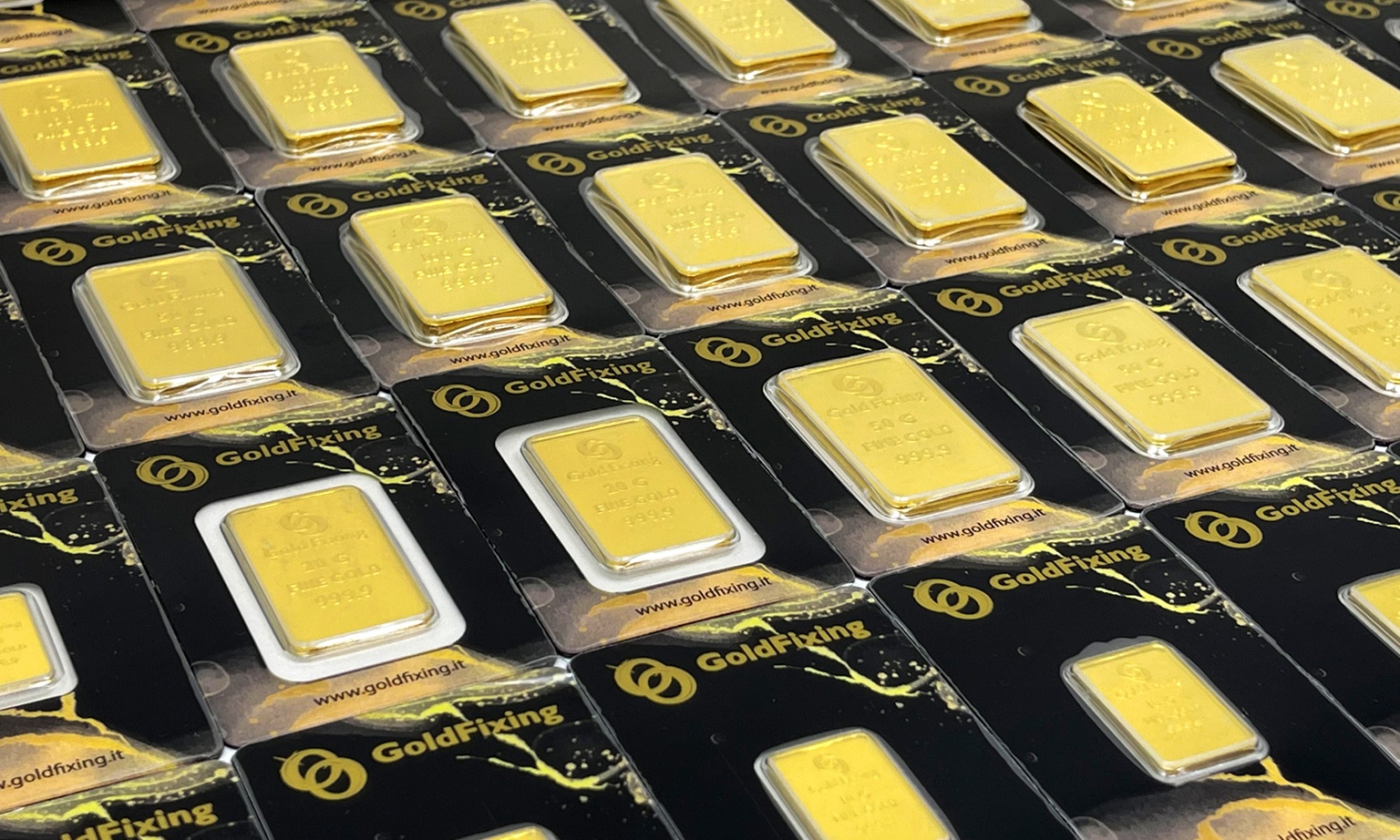

Diversification of investments encourages to reduce risks of loss, in case one investment fails. Gold is considered a good chance of diversification because it offers multiple benefits if compared to other investments.

In the first place, gold is a limited resource and also its supply is, making it a permanent and reliable option if compared to other resources or currencies that can be printed or made of your choosing. Gold is also considered an insurance against inflation and a protection for the assets because it tends to increase when other activities lose their value.

Gold has also proved to resist economic crises. During times of instability, gold increases its value, offering a strong coverage against the risk of loss.

It is an option of liquid investment and easily exchangeable; it can be purchased as gold bars and coins on specific markets all over the world.

Diversifying with gold can be a good strategy of investment to diversify the portfolio and reduce risk of losses.

Like any other investment it is important to conduct suitable research and consult a financial expert before purchasing gold or making an investment.