With the entry into force of the new Budget Law 1/2024, today investing in gold is a more regulated operation. This law requires maximum fiscal transparency and the possession of a complete documentation regarding the purchase of precious metals. Without the documentation the taxation on capital gains will be applied on the entire amount obtained from the sale, instead of the previous 25%.

In the past years in case of lack of the purchase documentation, the taxation was more advantageous. However, the new law requires a full documentation in order to grant the correct application of tax rates. This change highlights the importance of operating with clear professionals who can ensure compliance with tax regulations and the full documentation of transitions.

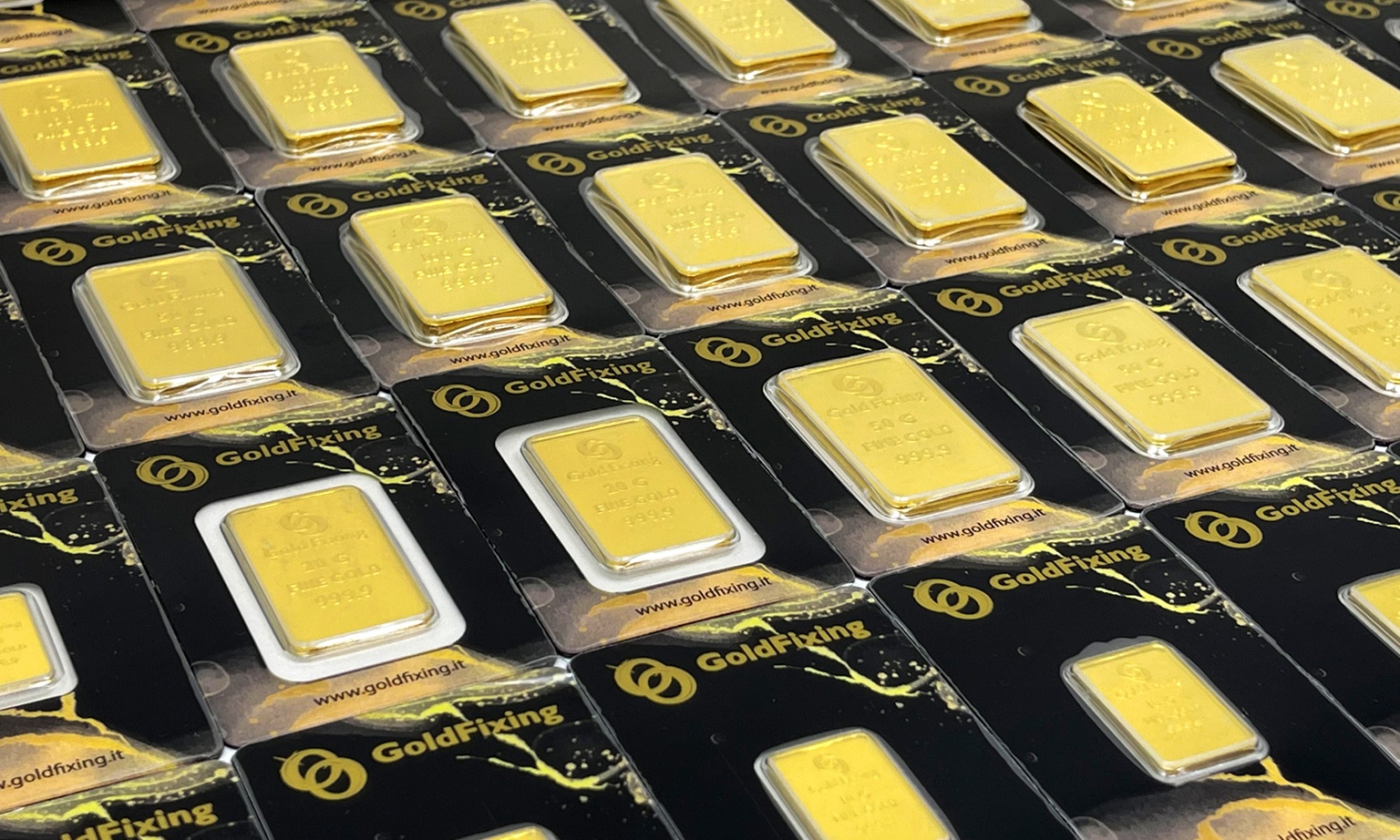

Why is GoldFixing the right choice?

In a changing regulatory landscape, it is fundamental to rely on trustful partners. GoldFixing stands out for its compliance to the laws, transparency on the transitions and high-quality service for the clients. With over 10 years of experience the team of experts of GoldFixing is highly qualified and prepared to help the investors through the process of investment. From providing clear and detailed information about transactions to verifying the origin of funds and a proper declaration of capital gains for tax purposes, GoldFixing offers consulting at 360 degrees in order to grant safety and confidence to the investors.

The new law establishes the recovery of additional 196 million euros for the Government yearly, relying on the data of 2022, when the declared sales of gold have exceeded 3 billion euros. However there is the risk to encourage the informal sale between private parties, considering all the consequent tax and legal implications.

A positive aspect of the new regulation is the incentive to rely on registered companies, like professional operators in the gold field who are registered with Banca d’Italia. This can contribute to reducing scams and other issues related to purchases between private parties.

Do not forget

During the purchase, investment gold is VAT free, while the other precious metals are subject to VAT, making them less convenient for investments. Moreover, the revenues coming from the resale of precious metals do not add up to personal income, keeping the limits of IRPEF (personal income tax) unaltered.

In a market where regulatory compliance is more important than ever, choosing GoldFixing as an investment partner enables you to safely face the new challenges of the capital gains law.