Gold is not just a secure asset, rather a stock of essential value that protects your savings from inflation. In the last few years we are witnessing how the Central Banks fear that inflation could corrode the value of their funds. To protect themselves from this possible risk, they choose to purchase physical gold.

In fact throughout 2022, the demand for gold by central banks reached historical highs:

Central banks all over the world have increased their gold stocks of 1136 tons, for a total value of 70 billion dollars! What do these numbers represent? We are talking about the highest increase of gold stocks in the last seventy years. Analyzing the last data of World Gold Council-WGC, Turkey has been the country with the highest purchases of gold. More specifically, as reported by the WGC, the Turkish Central Bank in 2022 collected 542 tons of official stocks, the highest level ever registered.

What are the reasons behind this choice? The inflation peak in Turkey was in 2022, exceeding 85% in October and decreasing 64% in December.

For this reason we can confirm that purchasing a big quantity of gold has the clear goal to protect the insatiable economy of a country.

China followed the footsteps of Turkey, purchasing conspicuous quantities of gold in 2022. Since 2019, for the first time the Chinese Central Bank started to purchase gold, with an increase of 62 tons in November and December; this data represents a step forward that helped China to reach more than 2000 tons of gold stocks.

Why did China decide to take this step? One of the reasons is the desire to limit its dependence on the American dollar, and this could be a wise choice to diversify its own resources.

To sum it up, Turkey and China have collected gold stocks for two reasons:

- As a protection against inflation

- Diversify the resources

However we cannot claim that these are the only two reasons behind the purchase of physical gold.

Why do central banks keep on purchasing high quantities of gold?

WGC questioned central banks about the reasons of their high investments of gold throughout 2022, here what they answer:

“Gold, thanks to its characteristics in times of crisis, represents a key factor for banks when it comes to investing in precious metals. What does it mean in a nutshell?

Historical importance: Physical gold has been extremely important for the world economy, acting as a base for most of the main currencies until 1971, when the United States decided to give up on the gold standard.

Absence of insolvency risk: contrary to obligations and national currencies, gold is not subject to the stability of the government or an institution. Investment in physical gold excludes any risk of solvency and worries of a possible default.

Preservation of its value in the long term: unlike national currencies that can depreciate because of inflation or economic changes, physical gold is not affected by the same fluctuations. Although it has short-term variations, gold is a long-term valuable stock.

Good results in times of crisis: Gold is a safe refuge that keeps or increases its value during times of financial crash or geopolitical uncertainty.

If we want to see the big picture, 2024 will probably be a year full of investments by central banks and account holders; however it is difficult to predict the future circumstances. Recent data have revealed a change in the trend compared to the 90s and 2000s, when many central banks used to sell high quantities of gold every year. Today they tend to have solid gold stocks instead.

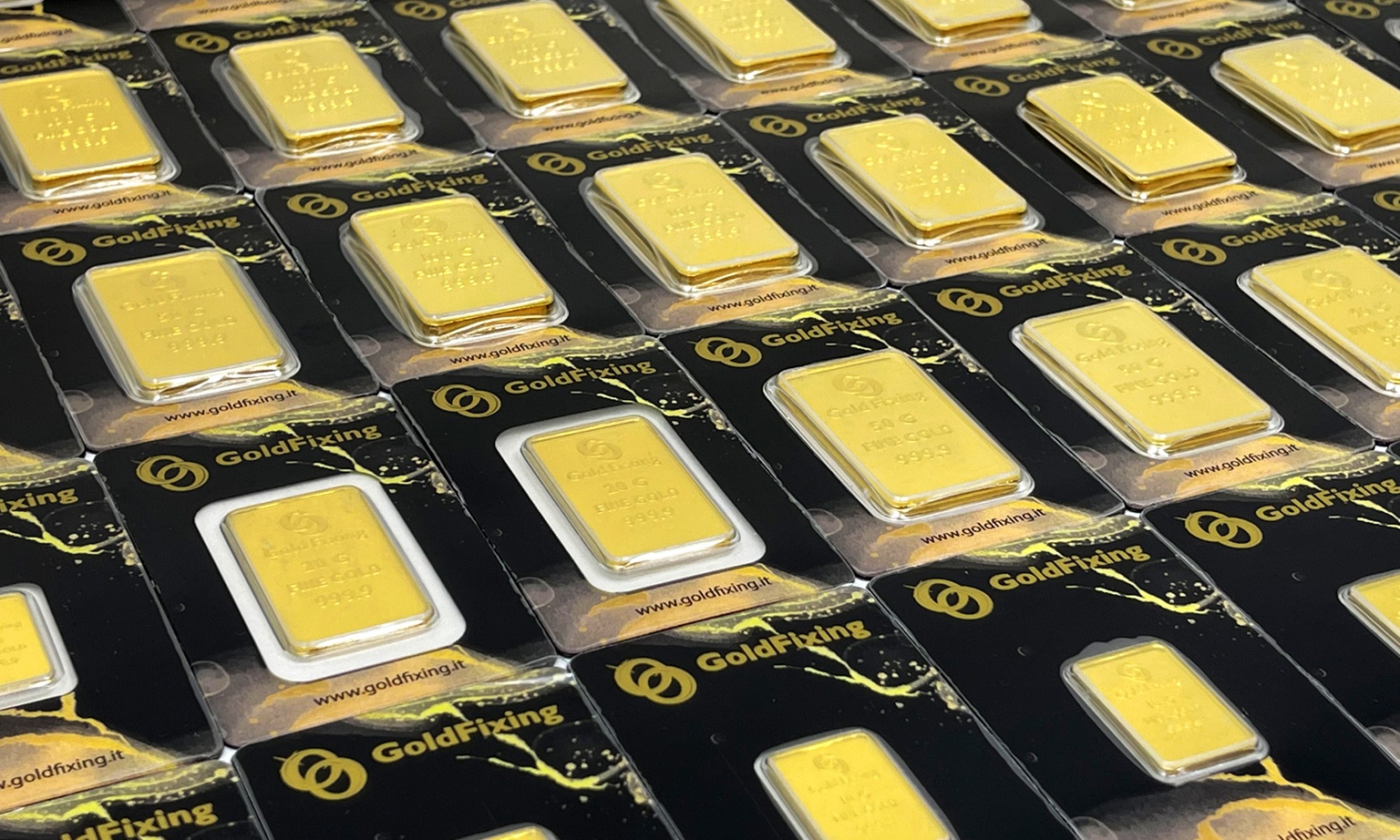

This is the reason why Gold Fixing suggests to consider gold as a precious option of investment. Gold, as a store of value and with its stability, offers a great opportunity to diversify your own portfolio, contributing to reducing the risks and preserving its value of investments in times of economic uncertainty.