The ongoing war between Hamas and Israel is having a strong impact on global financial markets, prompting investors to seek shelter in assets that are believed to be safe. The unexpected attack of Hamas on Israel last October has raised a climate of uncertainty, with evident consequences on different classes of assets.

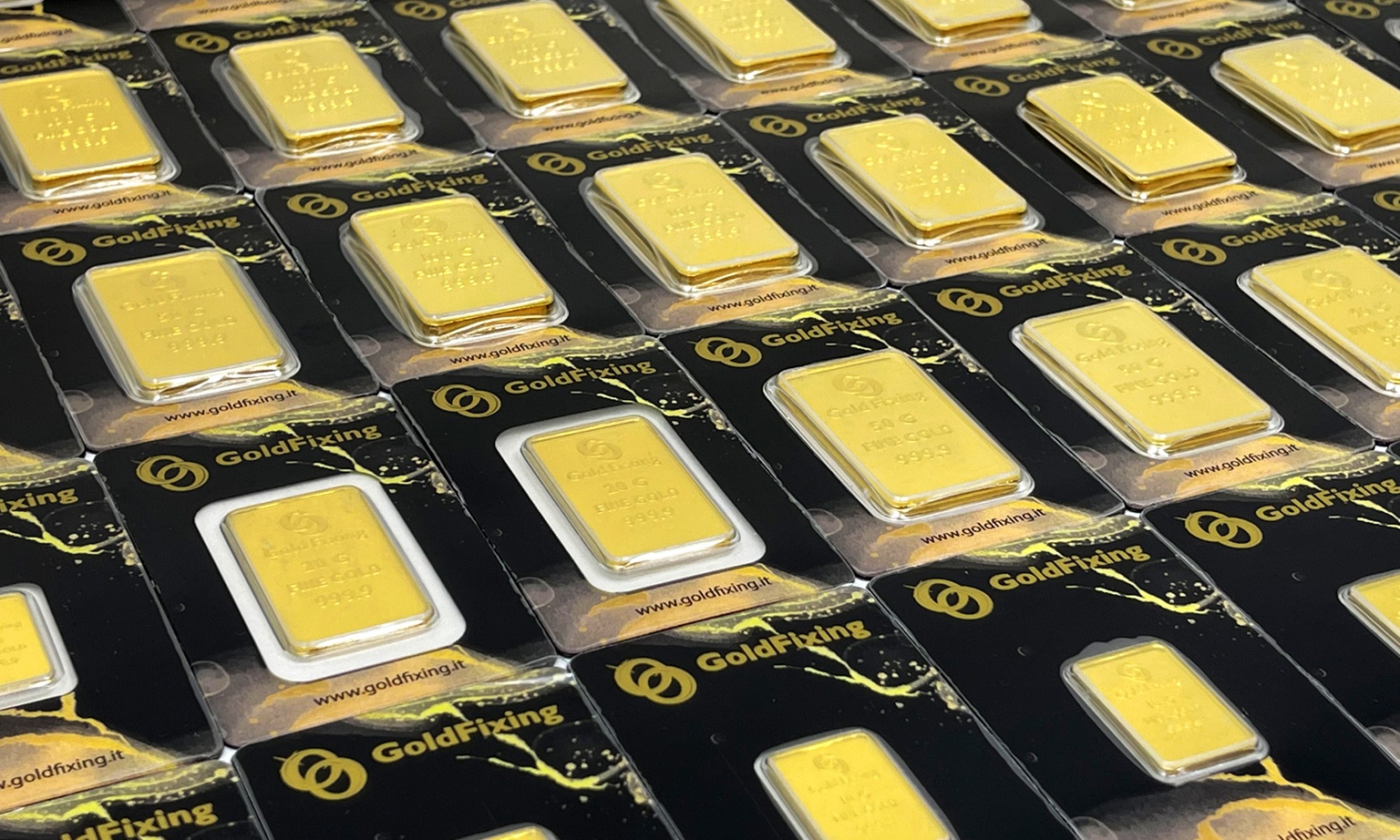

Investors who were concerned about the growing political instability, have looked for shelter in gold. Consequently, the gold price has jumped to over 1.870 dollars/ounce.

This precious metal is traditionally considered a store of value during times of geopolitical turmoil, because investors try to protect their own asset. The growing demand for gold is fostered by the concern of investors regarding a possible prolongation of the conflict and the alleged involvement of Tehran in the war. According to the experts, gold is confirming its reliability as a safe store of value amidst periods of international instability.

At the same time, the dollar has registered a strengthening, keeping its value as opposed to other currencies. In the past years the dollar has often benefited from international crises, turning into a store of value itself. The upsurge of tensions in the Middle East has encouraged investors towards the dollar and the yen, which are considered safe by tradition.

![]()

Financial market uncertainty is undeniable, due to markets in the red and a relevant increase of raw materials, in particular gas and oil. Analysts claim that the increase of geopolitical risks is affecting the choices of investors in buying assets like gold and also the increase of the demand of American Treasury bonds that were sold in the previous weeks. The US employment report, although positive, contributes to the uncertainty, because the investors are waiting for the next move of central banks. The ongoing war that has a strong impact on the unstable markets, highlights the importance for the investors to keep updated and adapt their strategies depending on the context. The need to supervise geopolitical developments is crucial to make decisions on investments.

In this context, gold has proved to keep its value over time and to increase during times of crisis, guaranteeing high protection on the assets. During conflicts, currencies may be devalued or have falls in trust and investors tend to consider gold as a more stable option because it is less affected by currency fluctuations. In such situations, diversifying the investments contributes to reducing risks on the portfolio.