In the investment world, the concept of “store of value” plays a key role; it is a good that keeps its value over time without any risk of depreciation or loss of purchasing power. In other words it is an option that investors consider safe in order to protect their savings from economic volatility.

For many years in Italy real estate has been considered one of the safest stores of value; . Italians have in fact purchased properties as a safe and stable investment. This trend has been fostered by a culture focused on the house as a synonym of financial security.

In the last few years there has been a debate about the actual power of real estate and its real value in our society, in fact real estate today has to face significant challenges questioning their status. In Italy and in other countries uncertainties in the real estate sector are rising.

Financial crisis highlighted the vulnerability of this sector; moreover, the last restrictions introduced on loans made the financing for the purchase of properties harder and less accessible. Banks request higher guarantees, making it harder for the families who want to buy a house. This is the reason why physical gold became a captivating alternative for investors looking for a store of value.

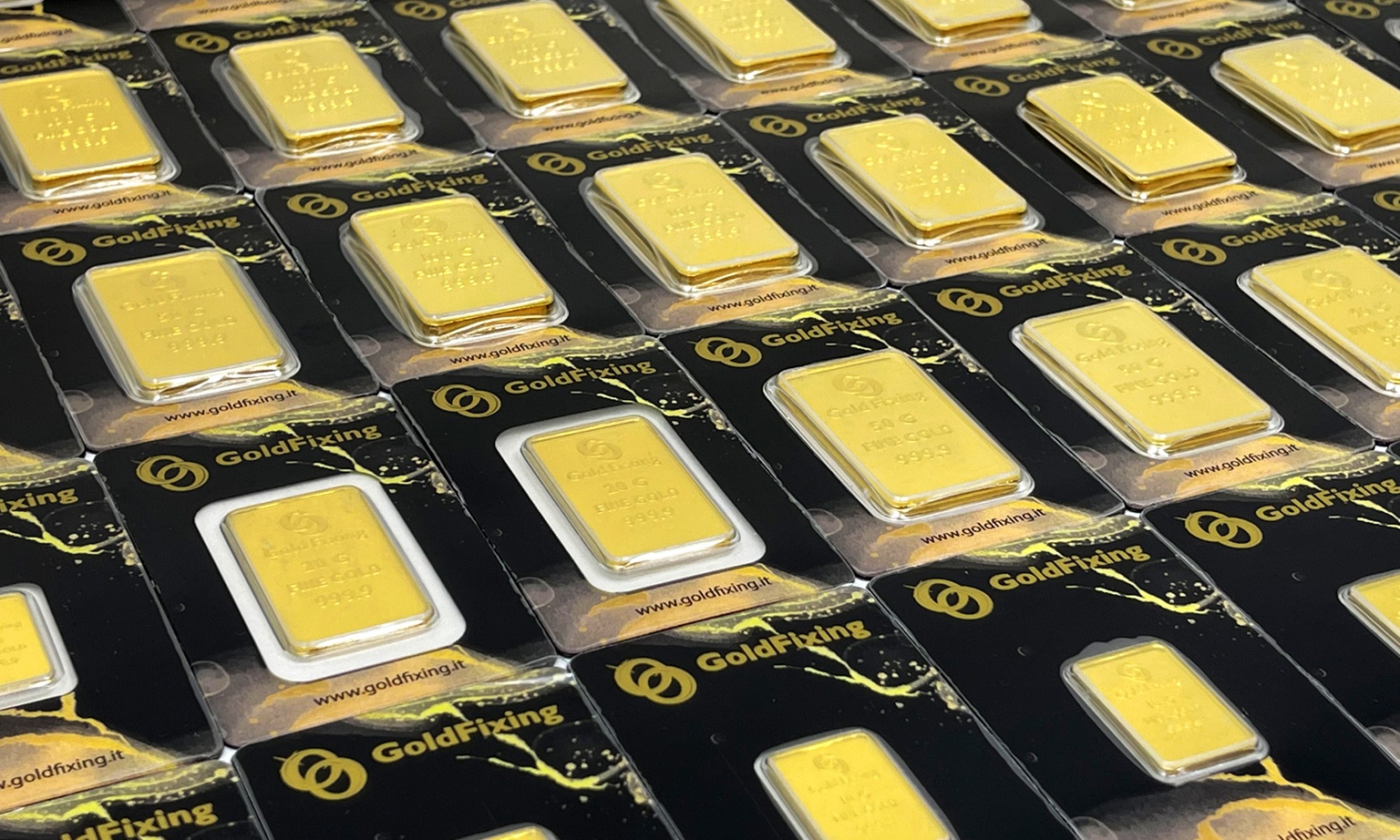

This is the reason why physical gold became a captivating alternative for investors looking for a store of value. Gold has a high liquidity, it is saleable it is saleable and it is considered the best store of value due to its intrinsic scarcity; while houses can be built anytime, gold is a natural good because gold deposits are doomed to run out,

making gold more precious.

Let’s make an example to show how convenient it is investing in gold!

On 4th January 2019 when gold had a value of 36.13 euros, if we had decided to invest 120.000 euros instead of buying a house, we would have purchased 3321.34 euros of pure gold 999.99.

If we had decided to sell it after five years, on 26th October 2023, when gold had a value of 60.70 euros/gr we would have gained 201.605,13 euros. So the capital gain as the result of this investment is 201.605,13- 120.000= 81605,31 euros; ; we subtract the taxation of 26% that the capital gain is subjected to, and we will have a net income of 81605,31 -26% = 60387,93. More precisely, we add the cost of the security boxes containing gold that may be around 100 euros per year, so in five years management costs will be 500 euros. If on 4th January 2019 we had decided to invest in gold bars, today our income would have been 60.387,93- 500= 59887,93 euros.

As we can see the differences between gold and real estate investment are evident and the choice will depend on personal preferences, investment goals and the evaluation of risks and opportunities. It is therefore important to carry out a careful evaluation in order to get the best results.

Now it is time to break the traditional patterns and recognize the strong potential of physical gold as an extraordinary investment asset. Join the other investors who have chosen gold as their store of value, letting go of all the prejudices about the real estate market.

And remember..it is always a good time to invest in gold!