Before introducing our guidelines it is important to understand what is “gold of investment”. When we talk about gold it is necessary to make a few distinctions.

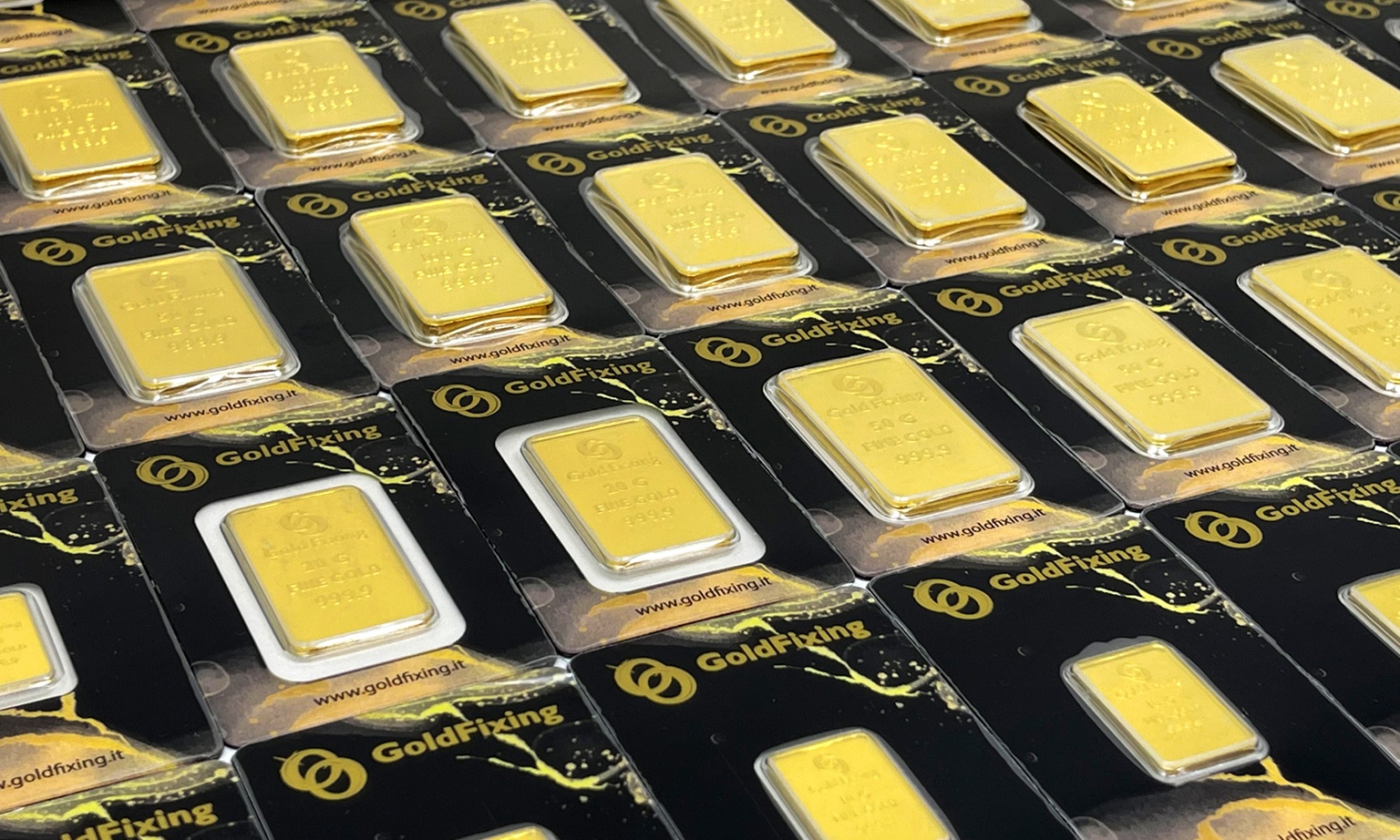

As stated in the law of 17th January 2000 n°7 article 1, gold of investment refers to “gold that presents itself as ingots or wafer of weights accepted by the gold market, superior to 1 gram, with a purity greater than 995 thousandths, whether or not represented by securities; gold coins with a purity equal or greater than 900 thousandths, minted after 1800, that had and still have legal tender in their original country, usually sold with a price not exceeding 80% of the value of gold contained in them according to free market”.

Therefore, jewelry and industrial gold do not fit the statement.

How does taxation on gold investment work?

When you ask us if it is weather or not a good moment to invest, our answer is that is always a good time to invest in gold and we are going to list the main reasons why gold is a great opportunity for investment.

In Italy gold is VAT free (except if it is purchased or sold to countries where VAT is required); the only thing required is a stamp duty of 2 euros.

Gold of investment is not subject to any declaration of possession, which is necessary in case of possession of bonds, shares or other investment tools. Gold is a convenient investment.

Do you want to sell gold as an investment? Here are some important tips:

First of all, gold is VAT free; that means that whoever lives in Italy and owns ingots or gold coins, does not have to pay taxes. When the investor wants to resell gold obtaining a capital gain, in this case taxes may apply.

What is capital gain? It is a gain due to higher sales value than the purchase value. Let’s make an example: if we bought a gold bar of 1000 euros and we sold it for 1100 euros, the capital gain would be 100 euros.

During these stages of purchase and sales it is necessary to keep all the documentation regarding the purchase of this metal, in order to submit a proper tax return. We are going to explain why:

- A) Documented cost of purchase: 1000 euros

B) Amount due of the sale: 1100 euros

C) Taxable capital gain: 100 euros

Tax due: 26%: 26 euros

What if you did not keep the invoice?

If you are in possession of gold and you’d like to resale it but you do not have the invoice. In this case you must be aware that the IRS assumes that there is a capital gain of 25% and consequently a tax of 26% will be applied on the total amount paid for the sale.

- A) Documented cost of purchase: unavailable

B) Amount due of the sale: 2000 euros

C) Taxable capital gain 25%: 500 euros

Tax due: 26%: 130 euros

Documentation proving the purchase becomes more important in case of capital losses (a negative difference, a loss between the price sale and the price of purchase). In fact, since the seller cannot prove the price of purchase, they could face another big loss because they will pay the taxes according to the standards above explained.

On the other hand, if there is documentation of purchase, possible capital losses can be compensated by the capital gain obtained within four years. Once the four years have passed without getting any capital gain capable of compensating for the previous losses, there is a residual loss.

Would you like to give away investment gold? Here what you must know

The tradition of giving away gold bars and coins is gaining a foothold, but everyone in possession of gold is questioning: is it necessary to deliver the invoice to the person who receives the gift for the tax return? The answer is no, because the invoice will be issued in the name of the purchaser. If you lose your invoice, the same concept of the previous paragraph applies.

Where is capital gain declared?

Among the important procedures to keep in mind is the insertion of capital gain in the RT table in section II of the form “Income of physical persons”. If your investment was carried out abroad it is necessary to specify in the table RW of the same form.

Contact us for free consulting and we will always choose the best strategy that suits you! And don’t forget our motto…it’s always a good time to invest!