During recent times, the increase of interest rates, which has been led by the European Central Bank (ECB), has brought different changes in the economy, with a strong backlash on family finances. In this changing economic context, the importance of smart strategies aimed at protecting their own savings and their assets, is crucial.

Impact on the family economy: increase of interest rates and rising expenses

The recent increase in interest rates has led to a significant growth of loan costs, affecting the floating rate loans. The families who have relied on these types of financing have noticed a significant increase in monthly rates. For example, a 30-year loan may switch from 800 euros per month to 1200 euros per month and be a financial challenge for many families.

The increase of interest rates has also affected the real estate market; those who are willing to sell their own house may be facing a less attractive demand because the potential purchasers may be discouraged by the high costs of loans. This will lead to a slowdown in the real estate market, with negative consequences on the capacity of investment on new properties or an improvement of the existing ones.

The solution: diversifying your investments with Gold

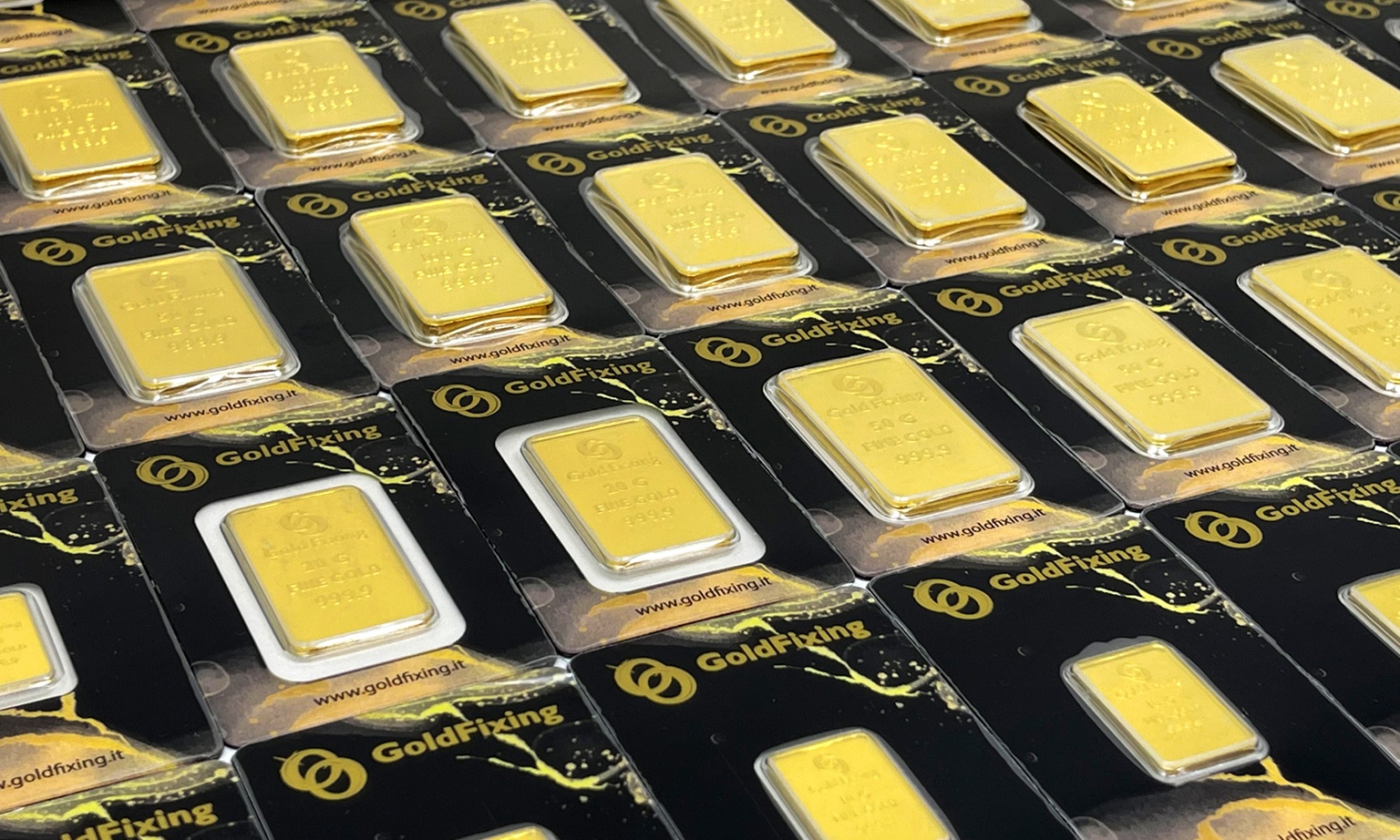

In this complex economic scenario it is very important to adopt a diversifying strategy on your investments. The team of Gold Fixing suggests to consider gold as a safe store of value during times of financial uncertainty. Gold has always represented a means of value protection against economic turmoil.

Gold is often considered an anchor for the investment portfolio; compared to other activities, gold’s value is less vulnerable to bonds and the stock market fluctuations. Whereas the interest rates are increasing, both the uncertainty of financial markets and inflation may negatively influence the efficiency of traditional activities, but physical gold can be a good cover.

There are different reasons that lie behind this perception:

- Record of value: gold has currently reached an unmatched value, exceeding 2.100 dollars/ounce. This record highlights the strength and the attraction of gold as an investment.

- Economic factors: the recent increase of gold has been encouraged by the investors’ wager on the potential cuts on rates by the Federal Reserve. This is an alleged move as a strategy to boost the economy, and investors see gold as a safe store of value in response to this scenario.

- Weakness of the dollar: weakness of the dollar which is affected by speculations on the monetary policy, made the purchase of gold more convenient. During times of economic turmoil, the overall tendency is to consider gold as a protection for the asset, especially when the dollar is in difficulty.

- Geopolitics and global tensions: the current geopolitical tensions, like the war between Israel and Hamas and the Russian attack in Ukraine, have aroused concerns and uncertainty on the markets. In these times of uncertainty, investors tend to seek refuge in gold, which is considered the best store of value.

Investment strategies: Gold Fixing’s advice

Gold Fixing suggests to consider gold as part of a strategy of investment diversification. Owning physical gold guarantees safety, because it is a concrete asset that does not depend on complex financial structures. Gold investment is VAT free and it is accepted as a worldwide currency. Furthermore, Gold Fixing commits to repurchase the gold that has been sold from all the investors.

Future perspectives: rate drop forecast in 2025

Even though the current interest rates are increasing, the forecast shows a possible drop in 2025. This may lead to a reduction in the loans costs and an improvement of economic conditions. Investing in gold today, during this period of interest rates increase, may benefit the investors from the possible drop in the upcoming decade.