A safe and convenient opportunity of investment

Financial crisis in 2008 upset the international economy, with the resulting necessity of introducing international regulations capable of preventing future financial meltdowns. For this reason preventive measures have been adopted, like the international Basel agreements III. These agreements aim to strengthen the regulations and manage the risks of banks . One of the important changes introduced by Basel III is the classification of physical gold as a risk-free activity. In this article we are going to discuss how Basel III converts physical gold into a safe and convenient opportunity of investment.

Basel III and precautionary regulations

The financial crisis in 2008, due to the American housing bubble, had a devastating impact on the global economy. To prevent these events from occurring in the future, precautionary regulations have been introduced in order to strengthen the financial stability. Basilea III is one of the international agreements aiming at improving the regulations and management of risks.

Classification of physical gold as a free-risk activity

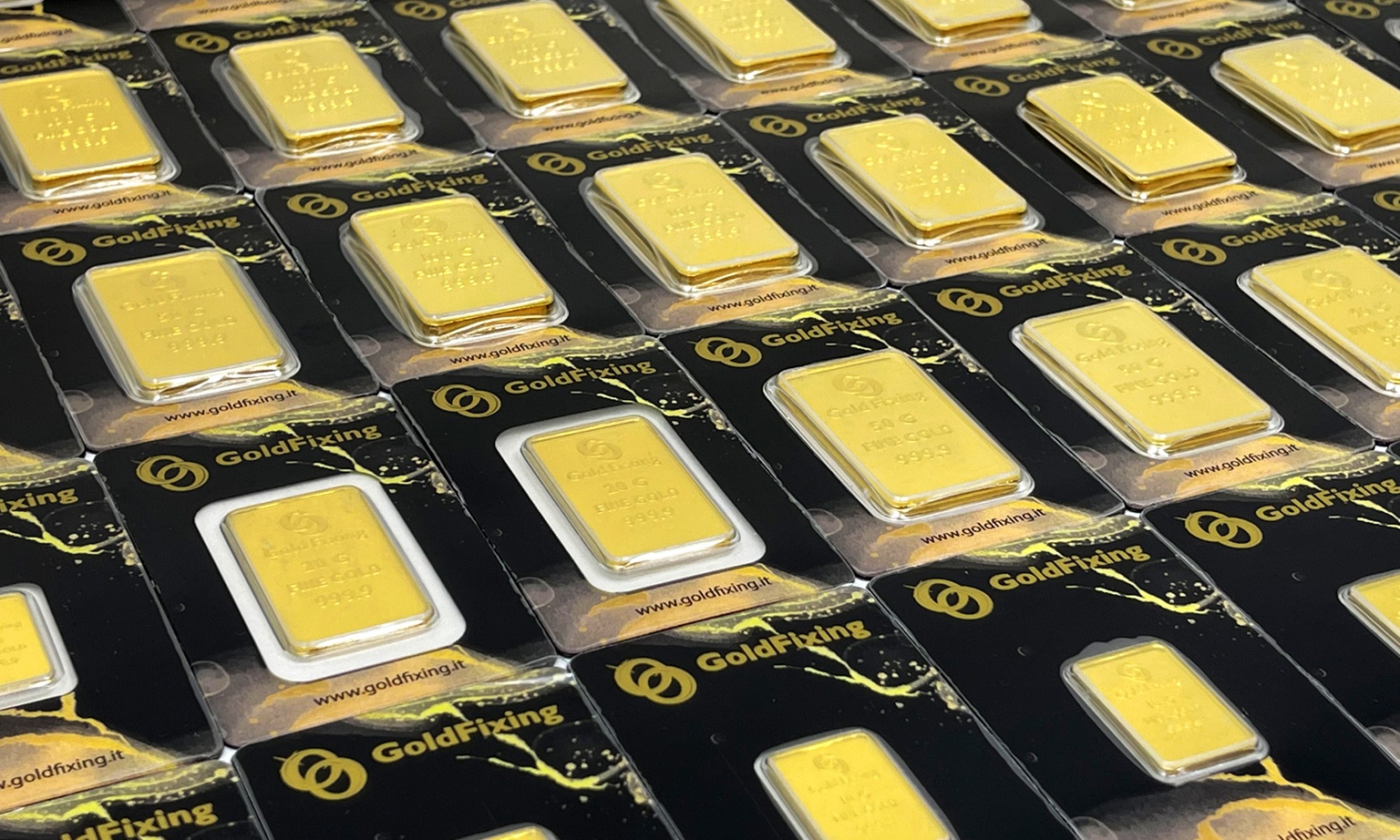

One of the meaningful changes spread by Basel III is the classification of physical gold as a free-risk activity, equivalent to currency and liquidity. It means that investors who own gold bars (physical gold) may consider it as a safe option for their investments. This new classification protects from dishonest mediators and speculative operations and offers purchasers the certainty to own a tangible and reliable asset.

Impacts on gold market and paper transactions

After the entry into force of regulations of Basel III, the banks in possession of unallocated or “paper” gold will be subject to stricter requirements. Net Stable Funding Ratio (NSFR) demands that banks own extra reserves in order to cover the positions of unallocated gold. This increase in costs could possibly slow the transactions of paper gold and increase the demand for physical gold. Consequently physical gold can benefit from a surge of interest from investors and a potential increase in value over time.

Physical gold is a safe and favorable investment for careful investors who wish to protect their own assets and have economic stability in a long-term perspective.

Get you free consultation, Gold Fixing will help you to find the best solution for your investments.

If you are looking for a safe investment, Gold Fixing is here for you!