Crypto currencies and ingots are two types of alternative investment compared to fiat currencies like dollar and euro. Analyzing the characteristics of crypto currencies and ingots, a few differences catch the eye.

They have different pros and cons that depend on your risk profile and your goals of investment, but we always suggest a diversified approach as a good strategy.

Crypto currencies like Bitcoin, Ethereum or Litecoin are decentralized digital currencies; they are not controlled by any central bank. Their value depends on supply and demand of the market. They are unpredictable and risky but their value presents an exponential growth.

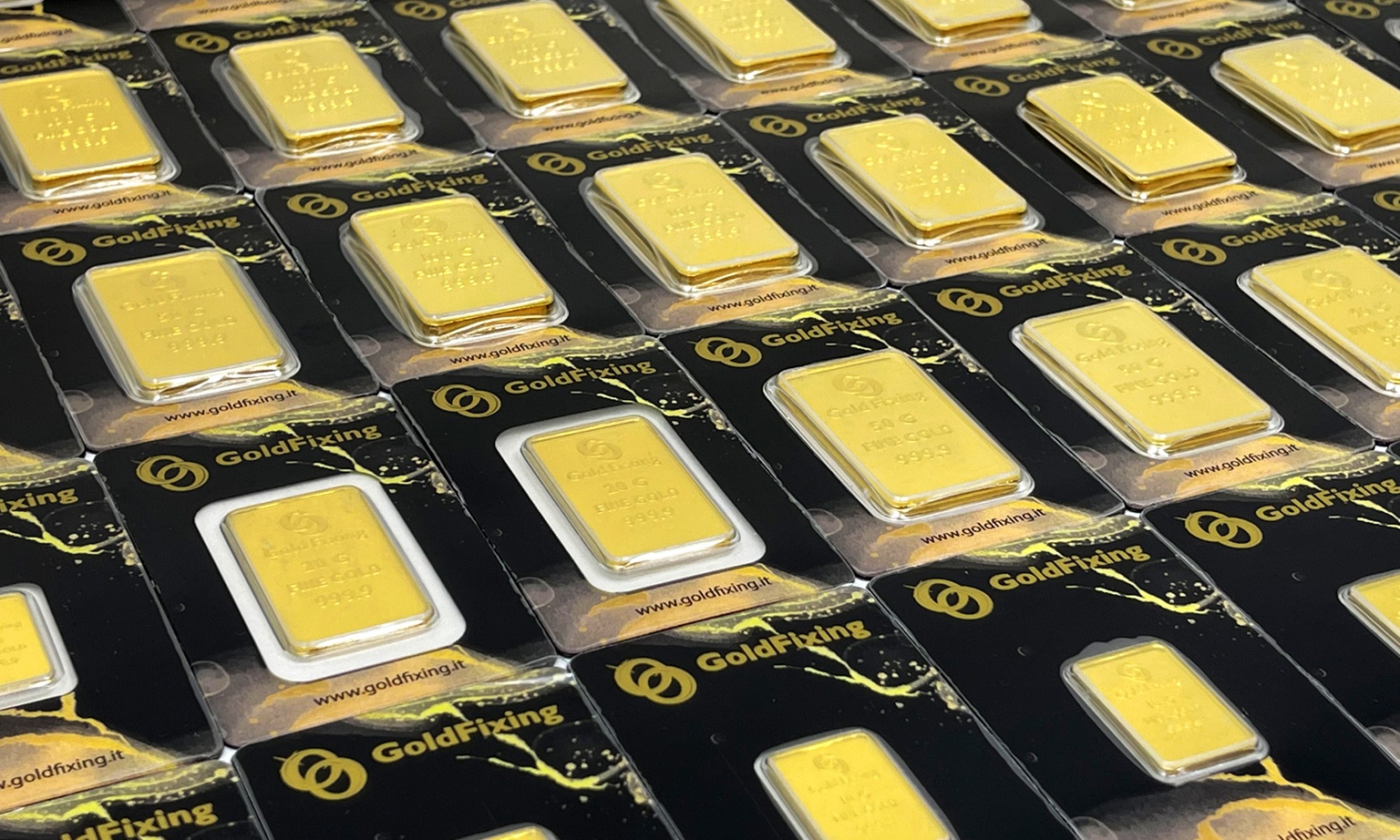

On the other hand, gold bars are precious tangible metals; they are considered a traditional store of value and they increase in value during times of inflation as shown in global charts. They are more stable but they have slower growth in terms of value because it is a medium-long term investment. Gold is easily convertible into money.

One of the aspects to consider is the risk factor.

Talking about crypto currencies, they are much more risky than gold bars. You could lose 50%-90% of your capital; in fact, the value of a crypto currency could completely reset. The data collected through the years show that any crypto currency has a long-term value.

Another aspect to consider is that the market of crypto currency is relatively new, illiquid and subject to fraud, and regulations aimed at protecting the investors are still insufficient and do not guarantee full insurance. In addition to this there is also the risk for new technologies to make some crypto currencies obsolete and reset their value.

Diversify your portfolio with Gold Fixing

Our team suggests and guides the investors in order to make targeted and low-risk choices for their investments. Besides ensuring that it is always a good moment to invest, it is important for us that our investors implement a strategy of diversification of their portfolio. If you do not implement this strategy just focusing on a single asset class, there is a high risk of resetting the value of your portfolio. Diversification of multiple asset classes reduces volatility and all the risks depending on the slowdown in economic growth.

If you are in favor of safety, stability and diversification, gold bars are the perfect choice if compared to crypto currencies. However it is not wrong to possess both the investments because they can be a good allocation strategy for the portfolio.

Contact us for free consulting and we will always choose the best strategy that suits you! And don’t forget our motto…it’s always a good time to invest!