Gold is still considered one of the best choices of investment because it is prolific, it means that it is a store of value and even during times of fluctuations, it will never reach the lowest value.

For this reason, gold will never be an asset with no value, due to the fact that it owns an intrinsic value.

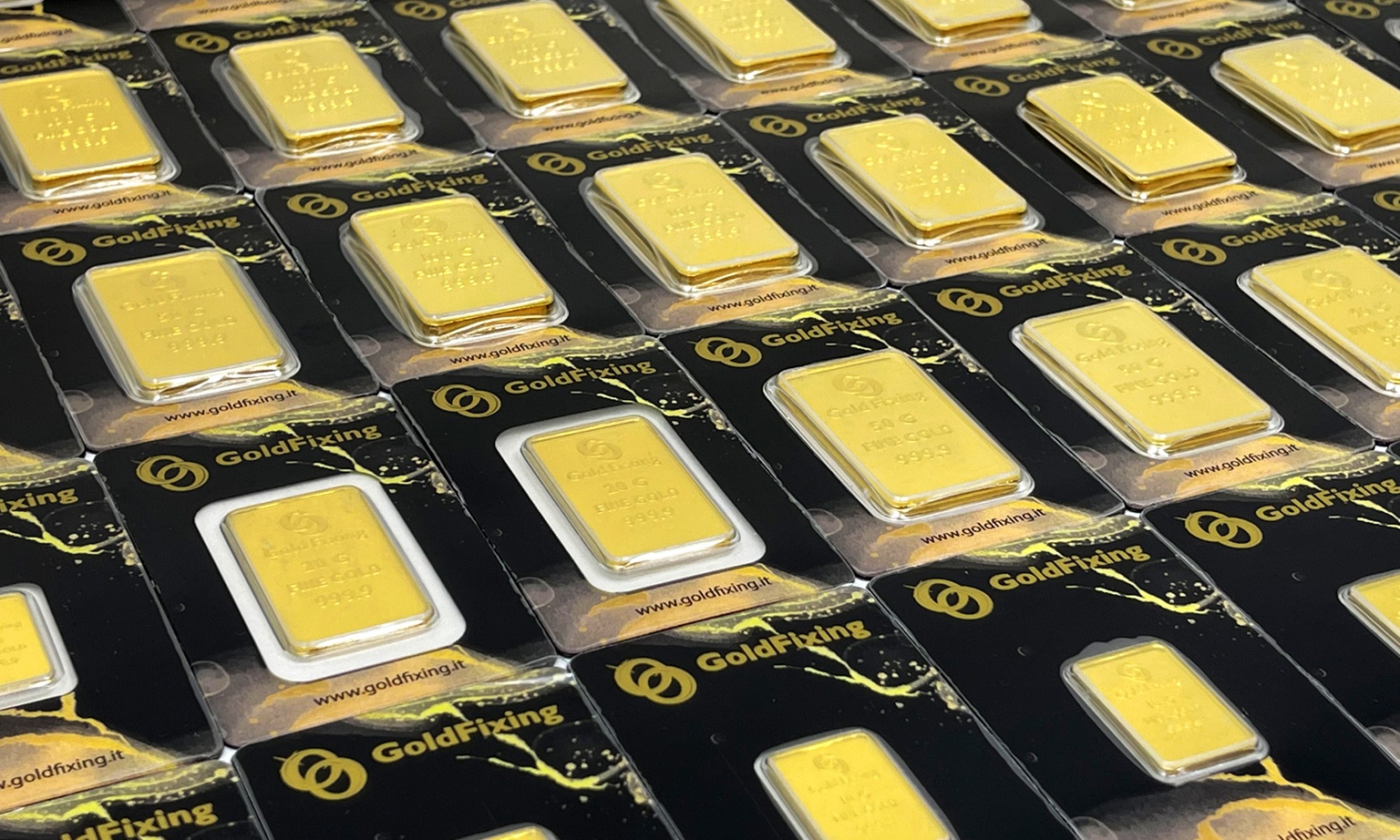

Investment in gold in its forms

As explained in the previous articles, investing in gold is a good solution to diversify your portfolio. In Gold Fixing you will find gold bars, one of the best forms of investment, and also gold pounds which is a valid alternative.

Going back in time, we know that the old name of “pound” was Gold Sovereign, and it is the gold pound with the highest value. At the beginning it was reserved for the English Royal Mint, but then it spread all over the world.

Today the gold pound is listed under the London Bullion Market Association,which is an association that establishes gold quotations and consequently also the pound ones.

The gross weight of gold pound is 7.9881 grams, the weight of fine gold containing 7.323 grams: it is 1.52 mm thick with a diameter of 22.05 cm.

Known as a typical investment, today is still one of the most used by investors. Let’s find out the benefits of this currency and the reasons why it is worth investing in it.

Benefits of investing in gold pounds

If you are wondering why Gold Fixing strongly suggests to invest in gold pounds is because of its material, gold which is the utmost store of value.

What are the other reasons to invest in gold pounds?

Due to its notoriety, the gold pound is the most famous currency.

Investing in gold pounds allows to cleverly subdivide the invested capital, thanks to the value of the pound. Furthermore, regardless of any change occurring in the world, the gold pound keeps its value, which is due to its material.

Reviewing the data, we can affirm that the demand for gold pounds is high, but the supply is not, so its value can increase over time. The charts of BullionVault show that investing in gold is always a clever choice because its value has always increased in the medium/long run.

Another aspect to consider is that it is easily available on the market and transportable; moreover, in contrast to what happens with gold bars, for pound are not required certifications regarding the provenience of the gold. Last but not least, gold pounds are VAT free.

What is the quotation of gold pounds based on?

London is the place where decisions about quotations of gold pounds are made. What does its value depend on? We must consider two aspects: how much gold is contained in a gold pound and its numismatic value depending on the year of minting, conditions and numbers of samples. All pounds minted before 1957 are named “old currency”, otherwise “new currency” if minted after that year. Since 2000 the English Mint has coined pounds as “Brilliant Uncirculated”. It is important to say that the numismatic value goes from a rate of C (common) to R5 (rare); the rarer it is, the more it is worth.

The new pound: King Charles III is the new face

The fiftieth face portrayed on the pound is King Charles III who was recently crowned as the successor of Queen Elizabeth. On the front side of this memorial currency it is possible to see the coat of arms of the United Kingdom, held by two heraldic animals, namely the English lion and the Scottish unicorn; on the downside there is the first portrait of the King.

The representation of the King is in accordance with the guidelines dictated by the British tradition which means that Charles III looks to the left and his mother’s profile to the right.

This currency is minted in gold 22 kt (916.7/1000) in its bullion version, and it is certainly an unrivaled currency for its mintion, design and history.

Contact us for free consulting and we will always choose the best strategy that suits you! And don’t forget our motto…it’s always a good time to invest!