Gold market analysis

It’s been a week lacking relevant events, with technical deadlines on Comex still distant. Looking […]

Continue »

The risks of digital currencies

The use of digital currencies carries risks that users should carefully consider before using them.

Continue »

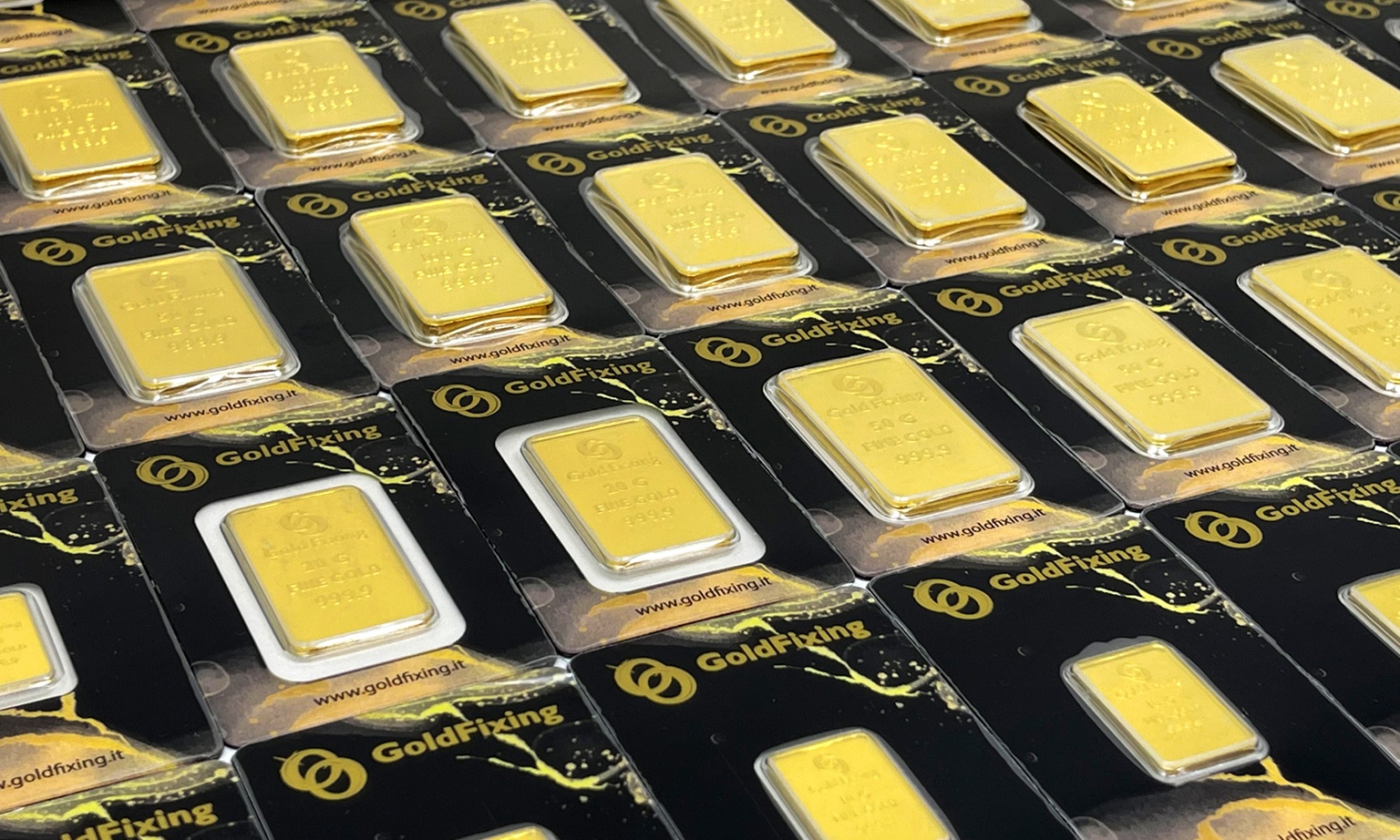

It is always a good time to invest in gold!

Physical gold is a smart investment, the safest way to invest and reduce the related risk.

Continue »

Crypto currencies vs ingots: is it better the unpredictability of crypto currencies or the stability of gold?

Cryptocurrencies and bullion are two types of alternative investments to fiat currencies such as the dollar or euro.

Continue »

Would you like to know more about fiscal aspects of investments in gold?

Contact us, our team of experts will be happy to offer you a free consultation and answer your doubts.

Continue »

The connection between gold and inflation

In periods of high inflation, the value of money tends to decrease, while gold tends to increase its value.

Continue »

Greece

Here we are, today is the deadline for the restitution of 1.6 billion euros that […]

Continue »

Greece: crisis and its socio-economic implications

The current situation in Greece is constantly evolving with political, social and economic interests which […]

Continue »

WEEE pirates

The beginning of a new market with its early regulations, has some flaws that may […]

Continue »

Report on gold quotation

On 13th June 2017 metals benefited from dollar setbacks, whose index had a decrease below […]

Continue »

No to deflation, yes to gold investment

Since 2014 Italy has been officially experiencing deflation. Financial crises may erupt in a relatively […]

Continue »

Invest in gold again

Many operators of international finances claim that gold is the only asset which is not […]

Continue »

A new leader for the fixing of gold

After more than one century the fixing of gold was entrusted to the Ice Benchmark […]

Continue »

Investing in gold pounds

Investment gold represents a special gift that can ensure a secure and prosperous future for our children and grandchildren.

Continue »

Give gold for Christmas: invest in the safety of your loved ones with Goldfixing

With the upcoming Christmas holidays, picking the best gift could be a tough choice. This […]

Continue »

Gold as a safe store of value: analysis and investment perspectives of 2024

Let’s analyze 2023, a year dominated by inflation and look at the prospects for 2024 which presents itself as a year of hope.

Continue »

How the increase of interest rates has affected family finances and how to protect your savings with gold

Let’s analyze 2023, a year dominated by inflation and look at the prospects for 2024 which presents itself as a year of hope.

Continue »

The new law of capital gains: why is it important to rely on professional operators like GoldFixing

The entry into force of the new budget law 1/2024 requires maximum fiscal transparency and the possession of complete documentation regarding the purchase of the precious metal. In the absence of such documentation, the taxation of the capital gain will apply to the entire consideration obtained from the sale, rather than the previously applicable 25%.

Continue »

Gold reaches new historical highs: an investment opportunity with Goldfixing

Gold continues to show a constant positive trend, confirming its position as one of the safest and most profitable investments. GoldFixing, which correctly predicted the latest rise in the price of gold, offers a complete range of gold products and personalized advice to maximize returns in the medium to long term.

Continue »

Gold on the rise: analysis of the factors behind the record of quotations

Gold continues to show a constant positive trend, confirming its position as one of the safest and most profitable investments. GoldFixing, which correctly predicted the latest rise in the price of gold, offers a complete range of gold products and personalized advice to maximize returns in the medium to long term.

Continue »

The impact of the Hamas-Israel war on global markets: gold has been reconfirmed as a store of value.

The ongoing war between Hamas and Israel is having a significant impact on global financial markets, pushing investors to seek refuge in safe assets such as gold.

Continue »

Care about your loved ones’ future: gift them with gold of investment!

Investment gold represents a special gift that can ensure a secure and prosperous future for our children and grandchildren.

Continue »

Basel III and physical gold

Physical gold offers numerous advantages as a form of investment, including protection against economic instability and the possibility of immediate liquidity

Continue »

Protect your assets from bank uncertainties, invest in gold!

Gold is not only a safe asset, but also an essential store of value that protects savings from inflation.

Continue »

Don’t you know how to divest your gold investment? Gold Fixing has the solution.

Not sure how to disinvest your gold investment? GOLD FIXING undertakes (complete with a signed unilateral contract) to repurchase the ingots sold at any time, at any price, especially with immediate payment.

Continue »

The “Gazzettino” speaks of us: investing in gold thanks to the reliability of Gold Fixing

Not sure how to disinvest your gold investment? GOLD FIXING undertakes (complete with a signed unilateral contract) to repurchase the ingots sold at any time, at any price, especially with immediate payment.

Continue »

Gold prevails on real estate as the best value investment

In the investment world, the concept of “store of value” plays a key role; it is a good that keeps its value over time without any risk of depreciation or loss of purchasing power. . In other words it is an option that investors consider safe in order to protect their savings from economic volatility.

Continue »

How to disinvest gold bars

L’oro continua a mostrare un trend positivo costante, confermando la sua posizione come uno degli investimenti più sicuri e redditizi. GoldFixing, che ha previsto correttamente l’ultimo rialzo nel prezzo dell’oro, offre una gamma completa di prodotti d’oro e consulenza personalizzata per massimizzare i rendimenti nel medio-lungo periodo.

Continue »

Illegal minerals

After two years of long negotiations, 2014 will be remembered for the proposal of a […]

Continue »

WEEE systems

Plants dedicated to recovery and treatment of WEEE divide the materials both manually and mechanically […]

Continue »